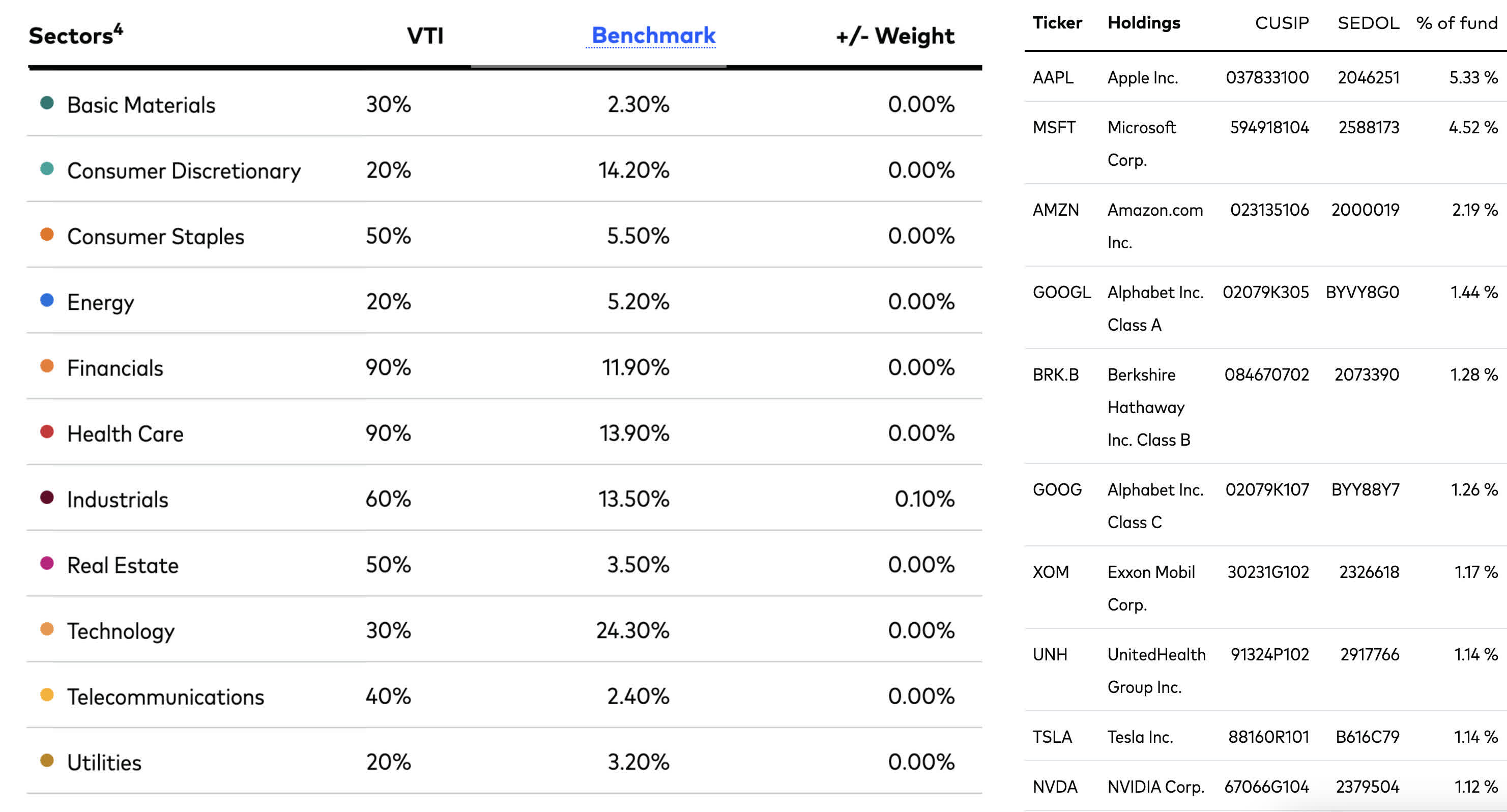

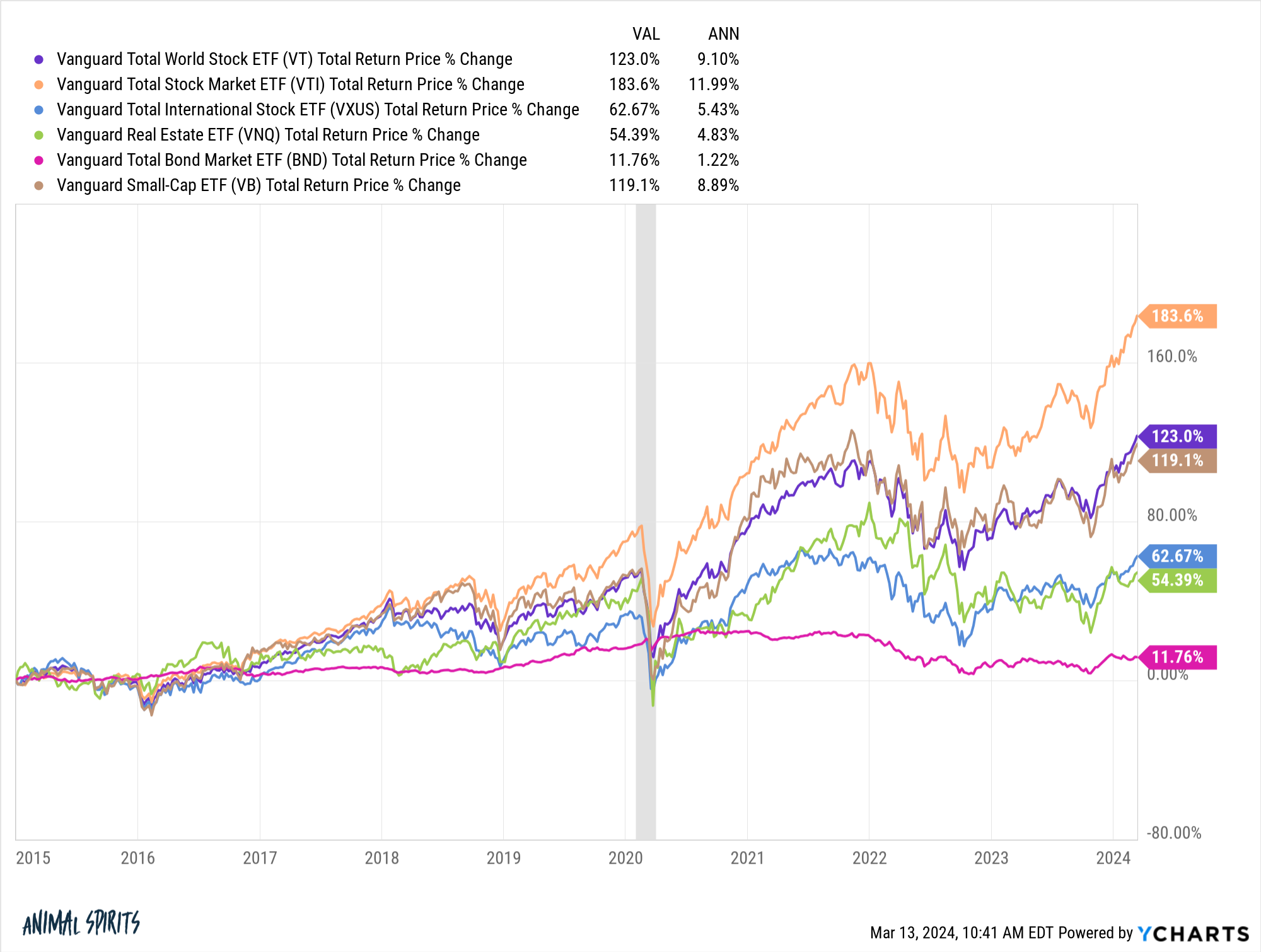

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Recent Post

- Sams Club Open Time

- Ny Wmu

- Phun Forum Celeb

- Skipthegames Boise

- Tntsuperfantastic Call

- Arrest Org Halifax County Va

- Is Bob Joyce Elvis Presley

- 20 An Hour Jobs Milwaukee Data Entry Level

- Airline Co Dispensary

- Micro Center Bundle Deals

- Soap Opera Dirty Laundry

- Ventura County Hurricane Hilary

- Brainy Quote One Single

- Harry Poter Wiki

- Standard Examiner Obituaries

Trending Keywords

Recent Search

- R Jerma

- University Of Washington Directory

- Warren Tribune Chronicle Obits

- Tvs At Sams

- College Baseball World Series Wiki

- Imdbpro Summer Of Sam Behind The Scenes Video 2000

- Chapel Locator Lds

- Ubreakifix Fix

- Quora Cicago Crimes

- Gun Memorial Indiana

- Texas Sky Tonight

- Jess Hilarious

- Henryhand Funeral Home Of Kingstree

- Butte County Fire Accidents Crime

- Skipthegames Kc

_14.jpg)