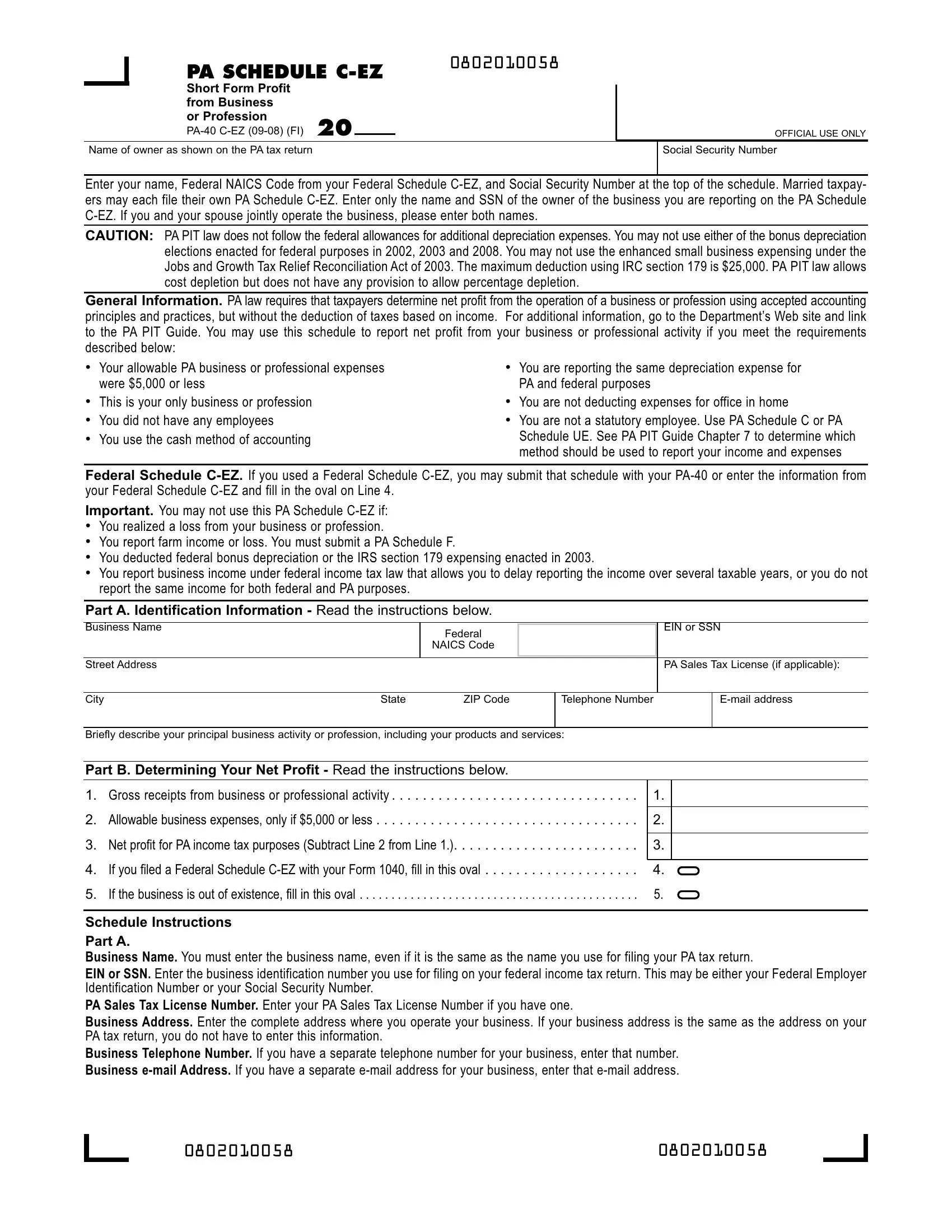

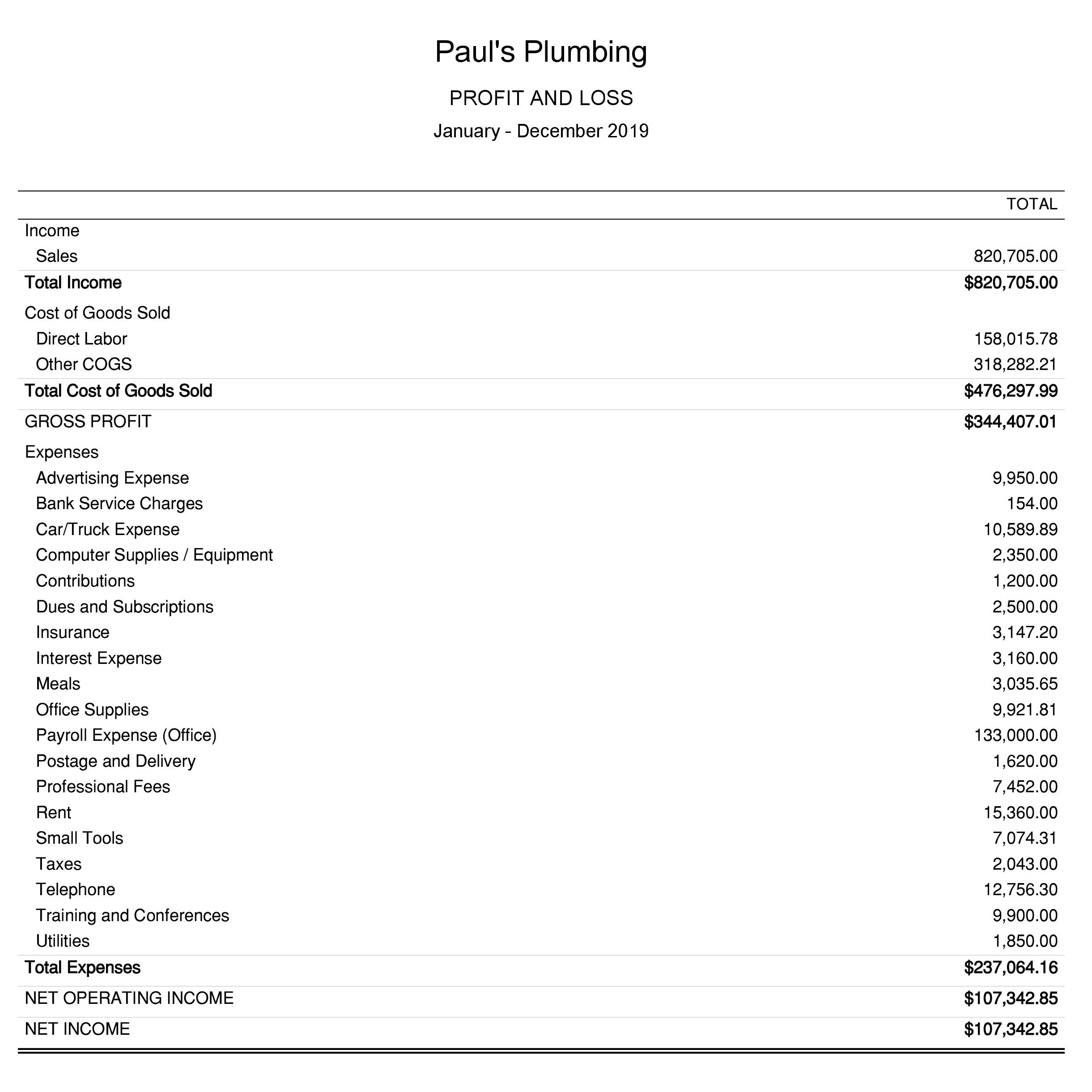

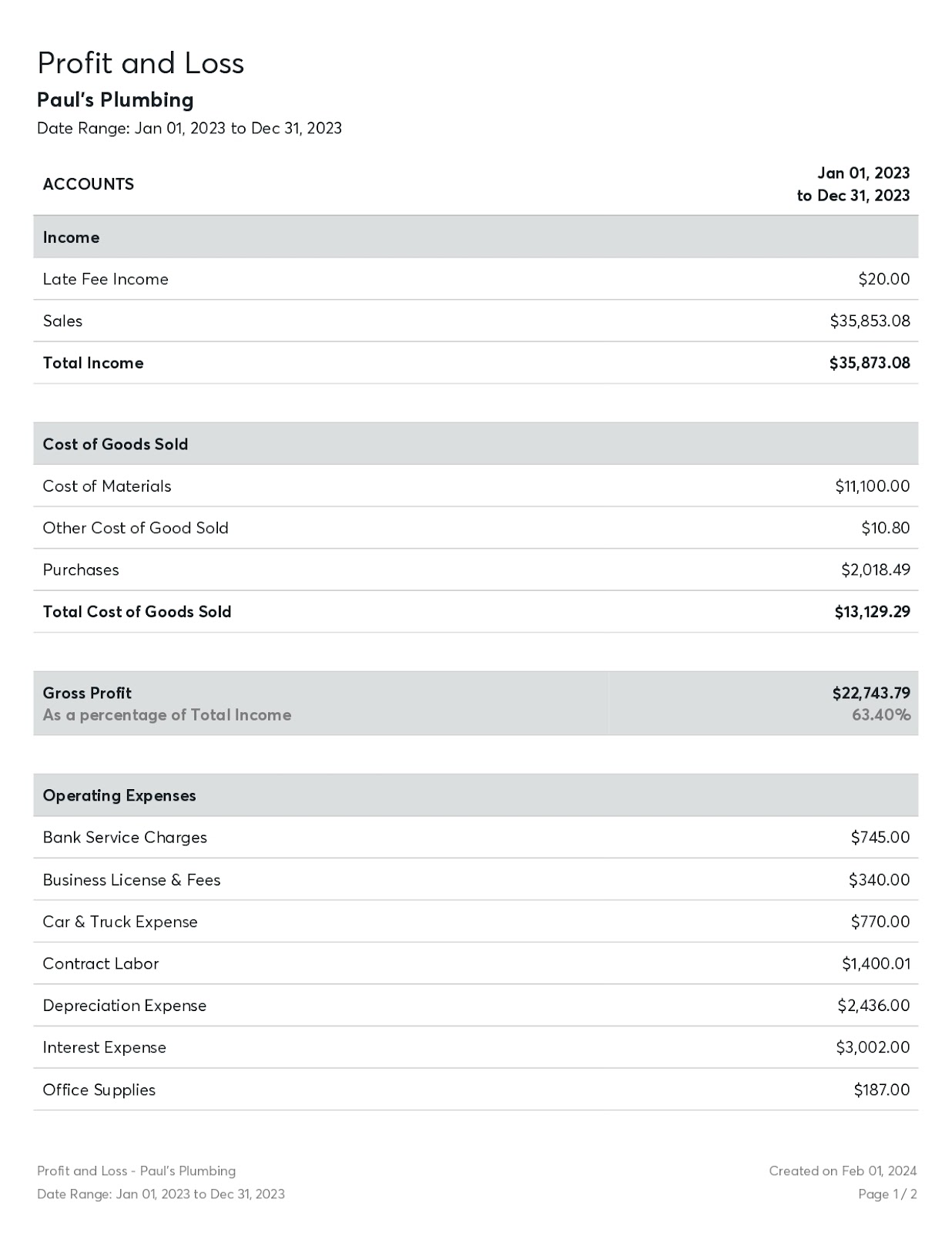

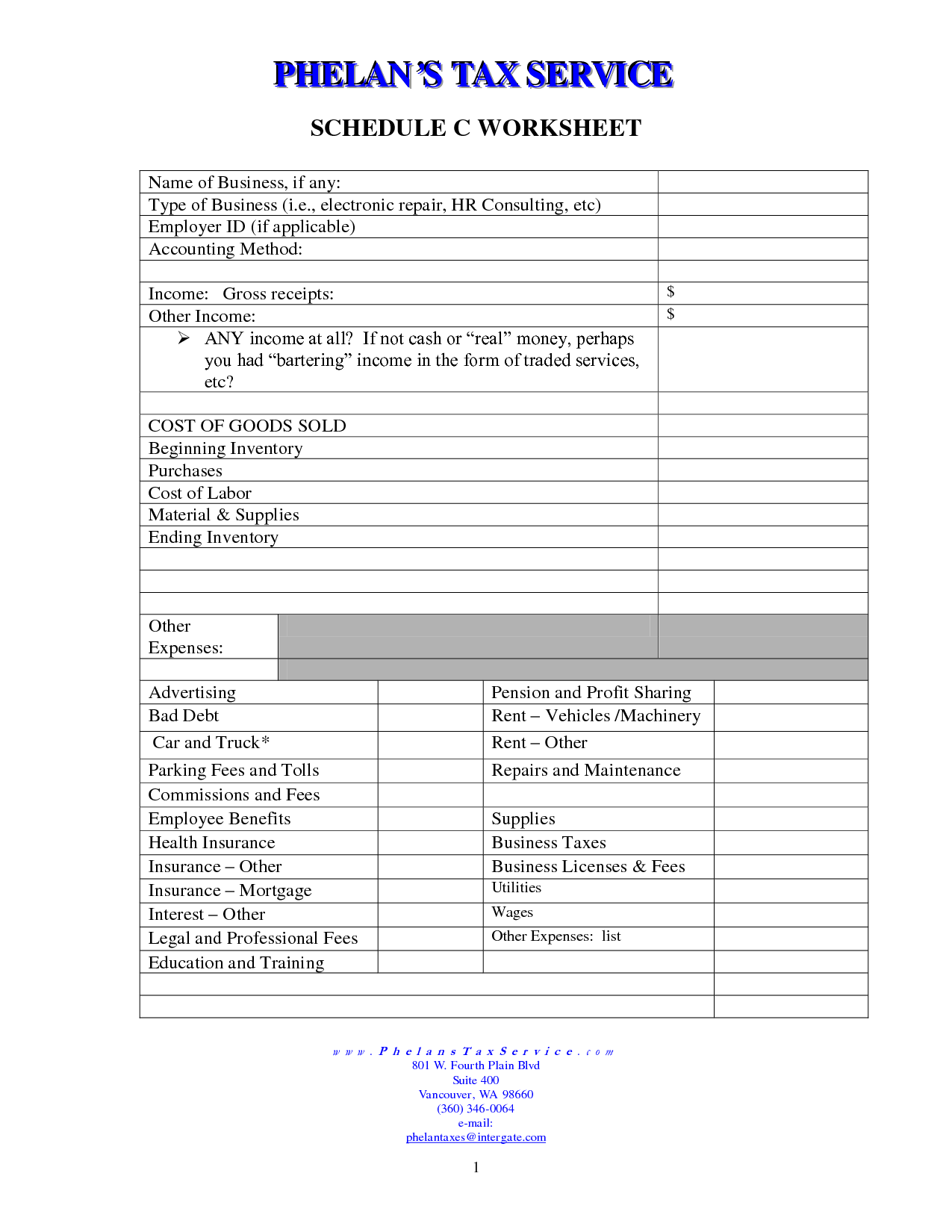

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Boo Who Rhistorymemes

- Navy Advancement Exam Results

- Amy Morrison Instagram

- Foos And Son Funeral Home Bellevue

- Greene County Mo Inmate Search

- Part Time Remote Rn Jobs

- Talking Next To Me Talking Next Me Lyrics

- 20 An Hour Jobs Hiring Near Me

- Women Actresses

- Tattoos Latin Kings

- The Beaver County Obituaries

- Monday Through Friday Jobs Near Me No Experience

- Agencies That Hire Cnas

- June 20 Zodiac Sign

- Ups Poster Printing

Trending Keywords

Recent Search

- Weekend Receptionist Job

- Lyft New Driver Promo Codes

- Gonzales Funeral Home Las Vegas Nm

- Kandiyohi County Jail Willmar Mn

- Rapids Daily Tribune Obituaries

- Gypsy Rose Crimw Scene Photos

- General Hospital Weekly Preview

- Erie Co Pa Obituariess

- Winn Dixie Starting Pay

- %d9%81%db%8c%d9%84%d9%85 %d8%b3%da%a9%d8%b3 %d8%af%d9%88%d8%a8%d9%84%d9%87fav Page Html

- New York City Jobs Indeed

- Httpswww Palmerwrites Caindex Htmlzip For Spartanburg Scpodcast Personal Html

- Hair Style Short In Back Long In Front

- Final Jeopardy 4 26 24

- Txdot Bid Items

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)